Energy Centre

Client: Private client

Project Value: £2 million

Estimated VAT Savings: £100,000

Location: London

Overview

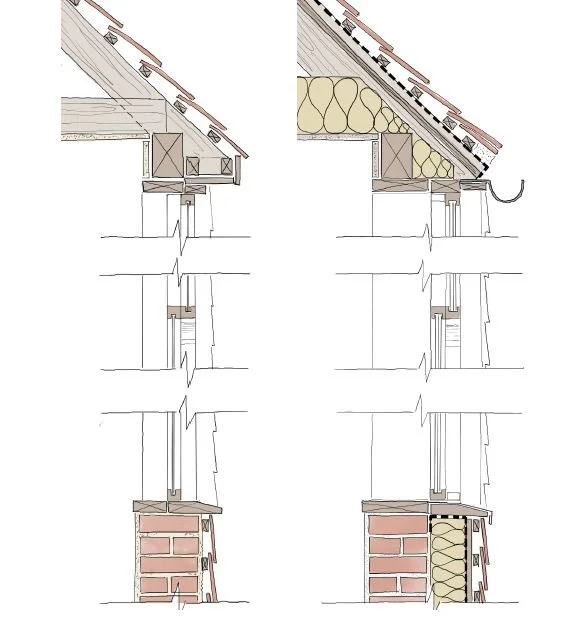

Landmark PT advised on the VAT treatment for the remodelling of a detached house in North London. The works involved the application of insulation to the external walls of the existing building, installation of air source heat pumps and solar PV.

VAT Issues

The project presented a range of VAT challenges, including:

Advise on the project procurement strategy to ensure the client enjoyed the benefits of the zero rate for the installation of energy saving materials

Analysis to establish scope of ancillary, incidental and integral works

Production of VAT liability statement with specification information to demonstrate extent of qualifying works

Our Role

We worked directly with the project’s quantity surveyor, architect, and main contractor to:

Establish the extent of zero rated works.

Prepare detailed VAT schedules for contractors to follow during billing.

Advise on procurement documentation to maintain compliance and maximise VAT efficiency.

Provide ongoing project support and VAT verification as works progressed.

Outcome

Through detailed analysis and proactive involvement, the client achieved an estimated £100,000 VAT saving on specialist construction costs, ensuring compliance with HMRC requirements while maximising available VAT reliefs.