Self-Build Barn Conversion

Client: Private client

Project Value: £1.5 million

Estimated VAT Savings: £260,000

Location: Cotswolds

Overview

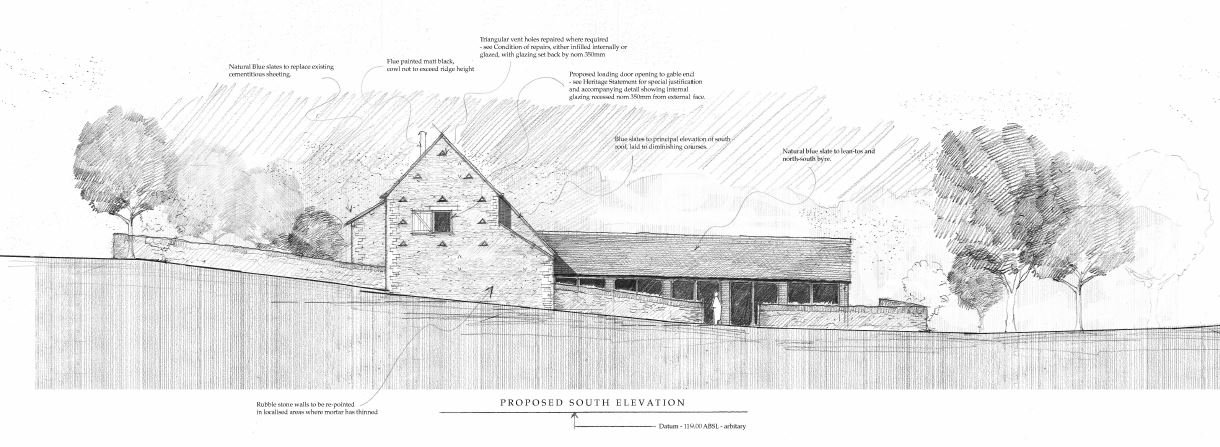

Landmark PT advised on the VAT treatment for the conversion and extension of a former agricultural barn into a high-end private residence in the Cotswolds. The project involved multiple trade contractors and extensive design input across structural, architectural, and interior packages.

VAT Issues

The project presented a range of VAT challenges, including:

Applying the 5% reduced rate for the conversion of a non-residential property into a dwelling.

Ensuring correct treatment for fitted joinery, bespoke kitchens, AV systems and interior finishes subject to 20% VAT.

Implementing cost apportionments across contractors where multiple rates applied.

Advising on the procurement and contractual structure to support correct VAT application throughout the works.

Preparation and submission of DIY converters VAT reclaim for the property owner

Our Role

We worked directly with the client, project architect and main contractor to:

Analyse the works and apportion costs between 0%, 5%, and 20% VAT rates.

Prepare detailed VAT schedules for contractors to follow during billing.

Advise on procurement documentation to maintain compliance and maximise VAT efficiency.

Provide ongoing project support and VAT verification as works progressed.

DIY converters VAT reclaim for the home owner

Outcome

Through detailed analysis and proactive involvement, the client achieved an estimated £260,000 VAT saving across construction costs, ensuring compliance with HMRC requirements while maximising available VAT reliefs.