Make Your Project Energy Efficient — and VAT Efficient

VAT on Energy Saving Materials

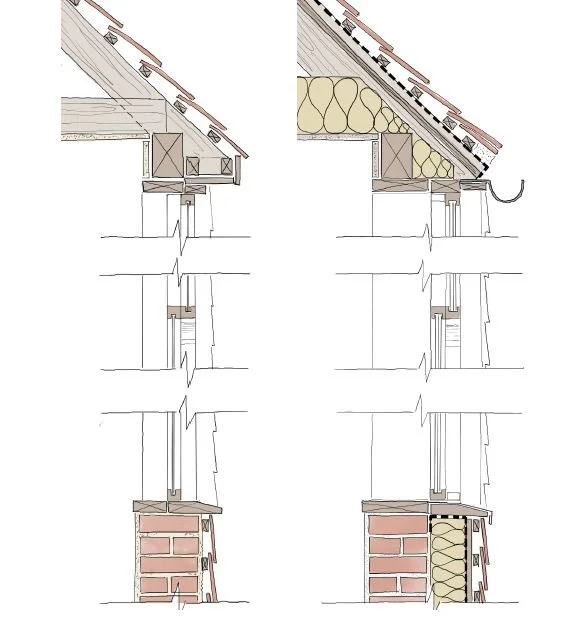

The installation of energy saving materials (ESMs) such as insulation, solar panels, heat pumps, and other sustainable technologies can now qualify for zero-rated VAT in many cases. This relief represents a significant opportunity for homeowners, developers, and contractors — but the rules are intricate, and getting them wrong can lead to expensive corrections later.

At Landmark PT, we help clients secure the maximum VAT relief available by analysing each project in detail — ensuring the works, contracts, and invoices are structured correctly from the outset.

Why It Matters

The government’s expansion of VAT relief for energy saving materials has made energy efficiency one of the most active areas in the construction sector.

However, the qualifying conditions depend on several key factors:

The type of materials and systems being installed.

Whether the works are supply-only or supply-and-installation.

The type and use of the property — private, charitable, or mixed-use.

The way contracts and invoices are structured.

These details determine whether the correct VAT rate is 0%, 5%, or 20%, and they are often misunderstood on site. Our role is to make sure the VAT treatment reflects the true nature of the works — correctly, confidently, and compliantly.

How We Help

Our service goes beyond written advice. We combine deep VAT expertise with genuine construction understanding to provide practical, hands-on support throughout your project.

We:

Review drawings, specifications, and quotations to identify qualifying elements.

Apportion project costs between eligible and non-eligible works.

Work directly with contractors to ensure the right VAT is applied as works progress.

Provide clear documentation and reasoning to support your VAT position if queried.

With around 200 live projects under our care — including numerous energy efficiency schemes — we have the insight and experience to deliver clarity where others hesitate.

Who We Work With

We advise:

Homeowners improving energy efficiency in their properties.

Developers and contractors undertaking sustainable building upgrades.

Architects and designers integrating energy-efficient systems into refurbishment projects.

Charities and community organisations investing in renewable energy installations.

Whatever your role, our goal is the same: to ensure your project benefits from every available VAT relief, implemented correctly in practice.

Talk to Us Before You Start

The difference between 0% and 20% VAT can be transformative — but only if the works are correctly structured and documented. Don’t rely on assumptions or general guidance: every project is unique.