Any VAT registered business providing construction services needs to make themselves familiar with major changes to the way VAT is accounted for from 1 October 2019 onwards. Although in practice the changes are on one level very simple they are conceptually difficult to understand just from reading HMRC’s guidance. We have attempted to explain the changes below and the potential impact on construction companies. Please do not hesitate to contact us if you would like specific advice for your business or project.

The current position

At present, sub-contractors in the construction industry generally charge VAT to their customers (who may be other sub-contractors or main contractors) and pay it over to HMRC and at the same time reclaim any VAT that they pay out to their suppliers. The VAT paid out by the customer to the sub-contractor is reclaimed from HMRC by the customer (where they are other construction firms) so there is in effect a circular movement of the VAT monies and all parties are VAT neutral. This process continues all the way up the supply chain until the services are provided to a final consumer who is not VAT registered who ultimately bears the burden of VAT.

The problem

However in recent years, fraudsters have infiltrated the construction supply chain and introduced businesses who collect VAT from their customers but do not pass this VAT onto HMRC. HMRC have confirmed this issue is costing them many millions of pounds per annum.

HMRC’s solution

In order to eradicate this problem HMRC have introduced new rules known as the domestic reverse charge (DRC) from 1st October 2019 whereby the collection of VAT on sub-contractor services in the construction supply chain is removed. i.e. so the sub-contractor no longer collects VAT on its services. This applies to the entire construction industry.

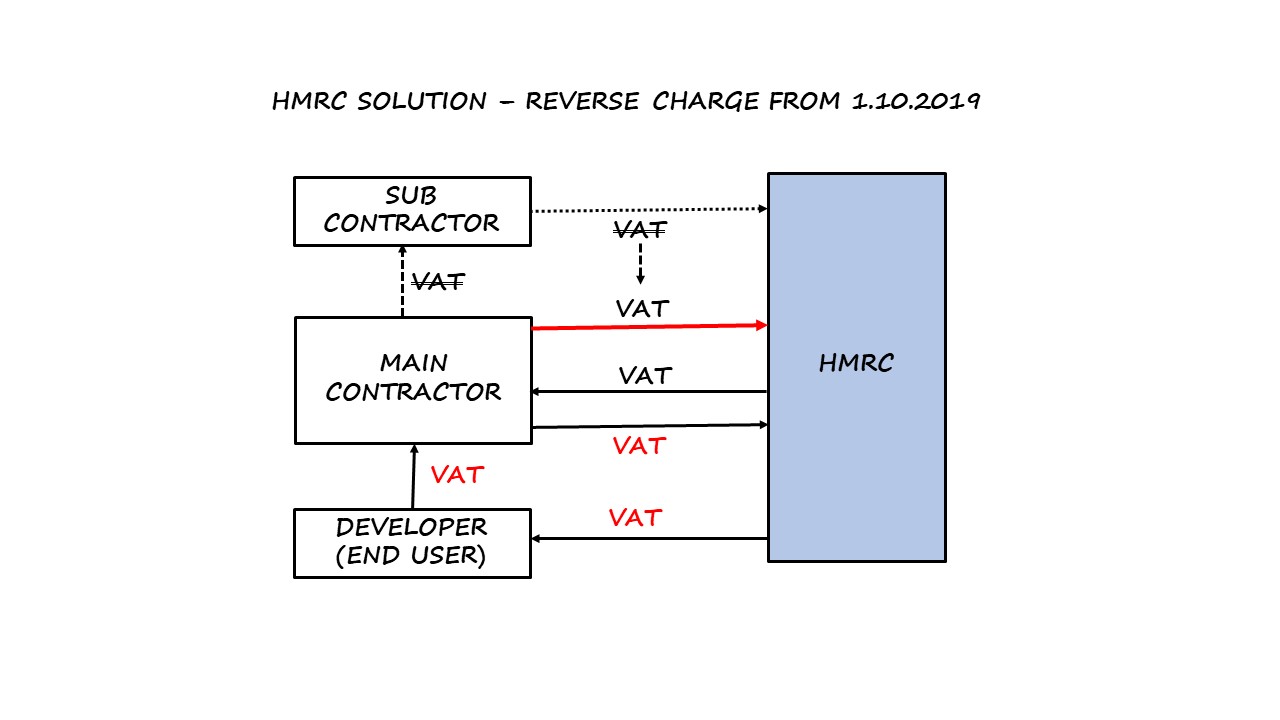

Where applicable the subcontractor notifies its customer that the DRC applies and the customer accounts on its VAT return for the VAT that previously the sub-contractor would have paid to HMRC. This VAT amount is cancelled out by the customer simultaneously reclaiming the same amount on its VAT return (see diagram below). This is the bit that is probably unfamiliar to many businesses although once understood as an idea is basically very simple.

The rules must be considered by any business that is VAT registered and registered on the Construction Industry Scheme (CIS). The CIS is another tax mechanism whereby building contractors have to withhold a percentage of any payment to their subcontractors and pay this sum to HMRC as an advance payment of tax for the subcontractors concerned – it is a quasi-PAYE system for the construction industry. Unlike the CIS the DRC applies to the whole value of an invoice.

Whilst these changes will undoubtedly be a compliance headache as businesses get to grips with the new rules the main issue is likely to be the negative cashflow effect for subcontractors who will be receiving 20% less cash when the measure is introduced in October.

Many businesses rely on the VAT that they carry on payments received up until their next VAT return as working capital. This is particularly so in the construction industry where margins are tight and payments terms are critical. Main contractors will receive a boost to their cashflow as they will no longer have to pay VAT to their subcontractors. At this stage it is not known how these changes will affect the overall construction supply chain over the next few months but it is anticipated that there will be casualties as this change in conjunction with other factors may be enough to tip struggling businesses over the edge.

It is recommended that main contractors consult with their sub-contractors to ensure there are not going to be issues where, for example, subcontractors are unaware of these changes.

Application of the DRC

HMRC have produced the following flowchart to help businesses decide whether they fall into the DRC. This flowchart is also included at the end of HMRC’s guidance note which can be found at https://www.gov.uk/guidance/vat-domestic-reverse-charge-for-building-and-construction-services

In general terms contractors that are VAT registered and CIS registered who are working for other VAT registered and CIS registered businesses should expect the DRC to apply unless their customer confirms otherwise.

In general terms contractors that are VAT registered and CIS registered who are working for other VAT registered and CIS registered businesses should expect the DRC to apply unless their customer confirms otherwise.

The works covered by the measure

The DRC applies to any services which are covered by the Construction Industry Scheme and will include most construction operations. Unlike the CIS which only applies to the labour element of any supply the DRC will apply to both labour and any materials supplied by the services provider so there is no need for an apportionment. HMRC give the example of a joiner constructing a staircase off site and bringing it to site. In this case even though the site works are low in value compared to the whole of the works the DRC applies to the whole value of the works.

Services and goods which are excluded from the DRC include works which are zero rated works, works not covered by the Construction Industry Scheme, the services of employment agencies that supply staff, professional consultancy services and supplies of goods on their own. VAT will be charged and invoiced as normal in these circumstances.

End–users

The DRC does not apply to works provided to persons who are not VAT registered or to persons not required to deal with the Construction Industry Scheme. VAT is charged as normal at the appropriate rate to the project concerned.

Where contractors are in contract with persons that are VAT registered and operating the CIS the recipient may confirm they are an ‘end-user’ and that the DRC does not apply. In this case VAT is charged as normal. This will generally include businesses that are not construction firms offering building services to others. Other entities to whom VAT will be charged as normal include:

a) a construction business that is connected to an end user entity by virtue of being part of the same corporate group or undertaking as defined in section 1161 of the Companies Act 2006

b) parties in a landlord-tenant type relationship where the parties share an interest in the same land

In general, a contractor can assume that they are not to charge VAT and advise their customer that the DRC applies and that the customer as recipient must account for VAT on the supply.

Sub-contractors

In general subcontractors supplying other contractors (unless for example that contractor is treated as an end-user by being connected to the developer of the land concerned) must not charge VAT and must issue DRC invoices which include the wording options as follows:

· reverse charge: VAT Act 1994 Section 55A applies

· reverse charge: S55A VATA 94 applies

· reverse charge: Customer to pay the VAT to HMRC

VAT accounting changes will also need to be implemented.

Contractors receiving DRC services

If you are a contractor receiving construction services from VAT and CIS registered sub-contractors you will no longer be charged VAT on the invoices for these services. You should ensure you receive DRC compatible invoices and that you account for the VAT that would of in the past been paid to HMRC by your sub-contractor. You reclaim this VAT at the same time (as now) so the net effect is nil in financial terms. You will need to ensure any self-billing invoices are also appropriately worded (see sub-contractor section above)

Given the current low awareness of these changes it would be prudent to ensure your sub-contractors are aware so that any issues can be ironed out ahead of the 1st October implementation date. Please email us if you would like a template email to send to your sub-contractors.